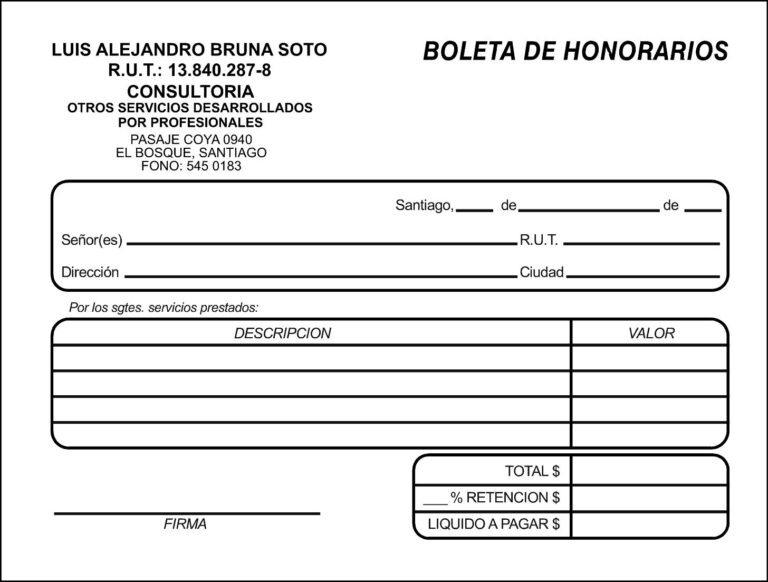

¿Qué es una Boleta de Honorarios en Chile?

Contenidos 👇

En Chile, una boleta de honorarios es un documento legal que se utiliza para declarar y pagar impuestos por servicios prestados como trabajador independiente. En otras palabras, si eres un profesional autónomo o trabajas como freelancer y has prestado tus servicios a, una empresa o particular, debes emitir una boleta de honorarios a cambio del pago recibido.

¿Quiénes deben emitir Boletas de Honorarios?

Todas las personas que presten servicios profesionales o técnicos por cuenta propia y no tengan vínculo laboral con la empresa o particular que les contrata, están obligadas a emitir Boletas de Honorarios. Algunos ejemplos son:

- Abogados/as

- Médicos/as

- Ingenieros/as

- Diseñadores/as gráficos/as

- Traductores/as

- Cocineros/as a domicilio

- Y otros profesionales independientes.

¿Cómo se emite una Boleta de Honorarios?

Para emitir una Boleta de Honorarios en Chile, debes seguir los siguientes pasos:

- Inscribirte en el SII: Para poder emitir boletas de honorarios debes estar registrado/a ante el Servicio de Impuestos Internos (SII) como contribuyente.

- Calcular el impuesto a pagar: El impuesto que debes pagar por cada Boleta de Honorarios es del 10% del monto total facturado. Además, debes tener en cuenta que existen ciertos gastos que puedes deducir antes de calcular el impuesto a pagar. Por ejemplo, los costos asociados al trabajo realizado (materiales,, insumos, etc.) y los gastos necesarios para desempeñar tu labor (transporte, arriendo de oficina, etc.).

- Generar la Boleta de Honorarios: Existen varios programas y plataformas en línea que te permiten generar Boletas de Honorarios electrónicas. Puedes elegir aquel que más se adapte a tus necesidades y presupuesto.

- Firmar y entregar la Boleta de Honorarios: Una vez generada la Boleta de Honorarios, debes firmarla y enviarla o entregarla al cliente correspondiente.

Consejos útiles para emitir boletas de honorarios en Chile

A continuación, te presentamos algunos consejos útiles para emitir boletas de honorarios en Chile:

- Mantén una buena organización: Lleva un registro detallado de todas las Boletas de Honorarios que emites y los pagos recibidos por cada una.

- No olvides declarar tus ingresos: Aunque trabajes como independiente, debes declarar todos tus ingresos ante el SII para evitar problemas legales y multas.

- Revisa bien tus cálculos: Asegúrate de que estás calculando el impuesto a pagar correctamente y deduciendo los gastos autorizados por la ley.

- Utiliza herramientas digitales: Existen varias plataformas en línea q,ue te permiten generar Boletas de Honorarios electrónicas de manera rápida y sencilla. Además, algunas de ellas te ofrecen servicios adicionales como recordatorios de pago y seguimiento de facturas pendientes.

- Sé claro/a al describir tus servicios: En la Boleta de Honorarios debes incluir una descripción clara y detallada de los servicios prestados, así como el valor total a pagar. Esto evitará malos entendidos y posibles conflictos con tus clientes.

Conclusión

En resumen, emitir Boletas de Honorarios es una obligación legal para todos los trabajadores independientes en Chile. Sin embargo, siguiendo algunos consejos útiles puedes hacer este proceso más fácil y eficiente. Recuerda mantener una buena organización y utilizar herramientas digitales para facilitar la emisión y seguimiento de tus boletas.